John Kenneth Galbraith wrote this many years ago:

A speculative outbreak has a greater or less immunizing effect. The ensuing collapse automatically destroys the very mood speculation requires. It follows that an outbreak of speculation provides a reasonable assurance that another outbreak will not immediately occur. With time and the dimming of memory, the immunity wears off. A recurrence becomes possible. Nothing would have induced Americans to launch a speculative adventure in the stock market in 1935. By 1955 the chances are very much better.

As Spot writes this, the DOW is at about 14,100, up over 100 points for the day. Spot wonders what part of "speculative bubble" that the public doesn't understand. One might think that the recent experience of the real estate market would be a cautionary tale, but apparently it isn't, at least for many. Including the Fed. Here's the text of of a September 18th press release:

The Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 4-3/4 percent.

Economic growth was moderate during the first half of the year, but the tightening of credit conditions has the potential to intensify the housing correction and to restrain economic growth more generally. Today’s action is intended to help forestall some of the adverse effects on the broader economy that might otherwise arise from the disruptions in financial markets and to promote moderate growth over time.

[It looks like the stock market is beginning to tank because of tightening credit, which is obviously provoking margin calls. We want to help investors live in a fantasy world a little longer.]

Readings on core inflation have improved modestly this year. However, the Committee judges that some inflation risks remain, and it will continue to monitor inflation developments carefully.

[Inflation really isn't so bad, especially if it helps Wall Street continue to fleece investors.]

Developments in financial markets since the Committee’s last regular meeting have increased the uncertainty surrounding the economic outlook. The Committee will continue to assess the effects of these and other developments on economic prospects and will act as needed to foster price stability and sustainable economic growth.

[Things look kinda bad. This subprime mortgage business has got a lot of people spooked, including a lot of foreign investors. But we'll throw gasoline on the fire as needed to keep it roaring. We'll ultimately run out of gasoline, but we'll worry about that when the time comes.]

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Charles L. Evans; Thomas M. Hoenig; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; William Poole; Eric Rosengren; and Kevin M. Warsh.

In a related action, the Board of Governors unanimously approved a 50-basis-point decrease in the discount rate to 5-1/4 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of Boston, New York, Cleveland, St. Louis, Minneapolis, Kansas City, and San Francisco.

Spot's comments are italicized in brackets.

Spotty, do you really think that the stock market is a speculative bubble?

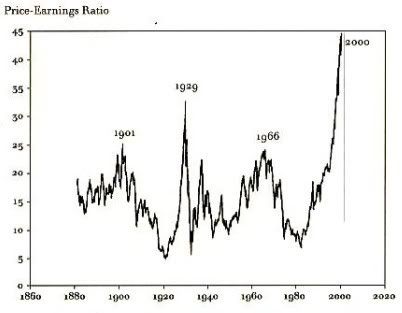

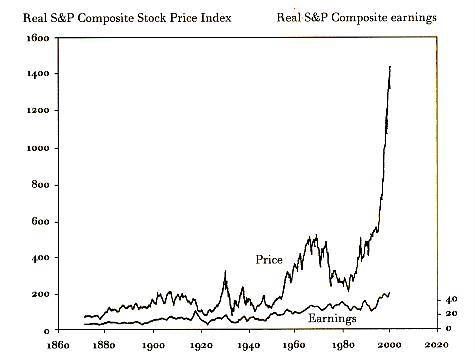

Yes, Spot does. After all, a corporation's worth is really based on what it earns. Stock prices deal with expectations about earnings, but those expectations have gotten way out of whack. Consider a couple of graphs from Robert Shiller's Irrational Exuberance, published in 2000:

It kinda goes off the chart at the end there, doesn't it Spot?

Yes. These data only go through 2000, but the situation today is much the same as 2000.What's going to happen, Spot?

That's the sixty-four dollar question, grasshopper. Here's what James Kunstler had to say recently:

With gasoline prices still skulking in the neighborhood of $3-a-gallon, despite oil priced above $80-a-barrel, political and economic leaders can pretend a little while longer that things are okay on the real life American scene. But between the dollar tanking in response to the Federal Reserve's Easy-Money-for-Big-Players policy, and the start of the home-heating season, you can be sure we are headed up to the $4-a-gallon range for happy motoring fuel before New Years.

There is still broad disagreement among commentators as to whether we are headed into a wild inflation or a grim deflation, but the emerging pattern looks to me like a big ocean wave that gathers itself into a high cresting peak and then collapses under its own weight -- that is, a technical wild inflation resolving into the low slop of people unable to buy anything. However you cut it, and from whatever angle you look at it, the bottom line will be a steeply lower standard of living for most Americans.

Bruce and Techno, Spot thinks this will also affect the militarism of the United States, but it could go either way.

No comments:

Post a Comment